The services industry changes at a frantic pace. To adapt in this dynamic environment, organizations must be able to quickly respond to changes in the market conditions, market opportunities and evolving customer expectations. Though most recognize the need to innovate, services companies have a remarkably difficult time finding business application solutions that can meet their needs in an effective, yet affordable manner.

Early-stage services companies have been forced to rely upon a hairball of dangerously unreliable spreadsheets and limited point solutions like QuickBooks. The relatively low cost of maintaining those systems masks the cost of inefficiencies in routine tasks like the monthly close or more importantly, the dissemination of reliable information upon which business decisions can be confidently made in a fast-paced environment.

Software companies are especially challenged. How can spreadsheets handle complex revenue recognition and fluid pricing models? How can “make do” accounting systems support strategic questions like:

- What was new business ARR?

- Did we expand ARR through customer upsells?

- How much ARR was lost through downgrades?

- How many customers churned?

Accounting teams frequently face these demands with inadequate tools. In many cases, QuickBooks was a workable and inexpensive tool. But now, they impose a number of pains.

- It’s difficult to find out what’s really happening across the business in real-time. Most systems are designed for an era when companies could wait until the end of the month to get the data they need. That’s not the case today—consolidated views and up-to-the-minute reporting can make the difference between thriving and barely surviving.

- Team members waste time playing “Hunt for the Spreadsheet”. Employees rely on spreadsheets to fill the information gap since data lives in so many disparate system. People end up spending more time hunting for data than actually analyzing it and making decisions.

- Financial consolidation takes age. Cross-posting transactional data between systems is time-consuming and the finance team works late every month to consolidate financial reports. Yet as hard as they work, weekly and monthly reports are delayed.

- Sales forecasting and budgeting processes rely on guesswork, rather than facts. Since it is difficult to get historic information in the right format in a timely manner to do trend analysis, employees put figures in spreadsheets based on guesswork. Even though the actual data exists somewhere, it’s too hard to find and extract.

- More accounting is done outside of the financial system than in it. Standalone financial systems are designed to automate a limited set of core accounting functions. As a result, it limits how companies can run their operations. As businesses grow, companies must adapt their processes to fit the application, rather than having a system that is flexible, scalable and will accommodate growth. It is easy to run out of headroom when companies have more customers, vendors or inventory items than many standalone financial systems can practically handle.

- It is too difficult to add new sales channels, product lines or revenue streams. Every time there is a change in the business, staff must work overtime to figure out workarounds to accommodate it. Standalone financial systems do not have built-in support for everyday functions like making simple changes across the matrix SKUs, adding new sales take rates, or handing bill of materials, kits and assemblies for manufacturing

inventory. Processes that cry out for automation have to be done manually or from spreadsheets.

Shiftgig Retools, Takes Off with NetSuite OneWorld

Originally founded as a job board for service workers, Shiftgig saw rapid growth when it shifted its focus to a mobile app for people seeking flexible work opportunities. It now provides over 30,000 on-demand workers (called Specialists) access to shifts in 14 US markets, as well as experiential marketing opportunities nationwide. As Shiftgig grew, its QuickBooks accounting solution couldn’t provide financial consolidation across three subsidiaries and was unable to meet sophisticated invoicing demands from larger clients.

NetSuite OneWorld Outshines Intacct

After a comprehensive evaluation process that included Intacct, Shiftgig selected NetSuite OneWorld for its functionality and low total cost of ownership. This solution would allow the company to continue to grow and deliver on its vision of providing financial opportunities for hourly workforce.

Born to the Cloud

Nobody understands the importance of true cloud better than services companies. There is a world of difference between software designed for the cloud and software designed for the legacy world. NetSuite has never been a desktop product. It has always been a multi-tenant solution. In contrast, QuickBooks Enterprise still comes in a desktop version. Even the hosted product lacks the always-upgraded, strong code base of real multi-tenancy.

Quantifiable Benefits

- Delay Finance and Operations Hires – Automation frees up finance and operations’ time allowing them to focus on revenue generating strategic projects, analysis and allowing the company to scale while keeping headcount flat.

- Revenue Recognition and Subscription Models – Stop the potential for revenue leakage and identify upsell opportunities.

- Streamline Billing and Invoicing – Reduce manual data entry and avoid errors with automated billing and invoicing. Collect cash faster and reinvest back into your growing business.

“With NetSuite, we have better financial data right at our fingertips to measure KPIs across balances, sales rep performance and transaction monitoring, all posted right within the application.”

Avigail Schlosser, Controller, Shiftgig

- Reduced Financial Close Time and Manual Data Entry – Automate and control approvals on transactions from AP Bills to Journal Entries, speed up period-end close due to system controls being in place, improve accuracy of financials, and reduce month-end processing costs and time.

- Lower Audit Costs – Every-changing compliance standards, small accounting teams and heavy spreadsheet use are time-consuming and subject to risk. This can lead to higher audit costs, or longer and more-involved audit processes.

- Platform for Innovation – Easily launch new business models and expand internationally with a platform that evaluates all possible ways to scale and increase revenue, and supports multi-currency, multi-entity and different accounting standards.

Suite Approach

A suite approach allows the whole company to view operations as a single version of the truth. Furthermore, predefined roles and dashboards that are oriented around a user’s day-to-day tasks allow for the most efficient consumption of information throughout the entire organization.

With a well-implemented cloud-based system, financial activities appear as soon as they are triggered. That, coupled with ‘anywhere-anytime’ access, means the decision makers can act quickly upon both adverse and favorable performance indicators. In that sense, decision-making becomes an activity where those tasked with executing on the company’s goals and strategy are able to do so with information that is akin to looking through the front windshield of a car, rather than constantly worrying about what is in the rear-view mirror.

Rapid Deployment with SuiteSuccess Enables Future Expansion for Atlanta Business Circulators

In Search of Maturity

Having depended on a desktop version of QuickBooks, Atlanta Business Circulators lacked a mature technology that could provide visibility into the business. The online version of QuickBooks proved unworkable; Lee knew he needed something with powerful reporting capabilities. Now with NetSuite, Lee expects throughput to increase 25% within five years.

Supporting a Growth Strategy

The new Atlanta Business Circulators has its eye on growth. Specifically, Lee envisions establishing a three-person sales team that would build the small company’s brand and bring in new clients from all over the state of Georgia. Lee needed a robust ERP system to make it possible.

“I didn’t necessarily need something that made us better today; I needed something that we could grow into.”

Robert Lee, President, Atlanta Business Circulators

A Tool for Success

Fast implementation meets divestiture deadlines

Quicken chose NetSuite OneWorld for its robust functionality and integration, ease of use, and scalability, seamlessly transitioning from a temporary QuickBooks Online environment in a five-month implementation by the October 1 deadline. NetSuite empowers a lean and growing operation of 100 employees, including 30 in Bangalore.

Robust functionality, automation for efficiency

Efficiencies gained through the system and easy integrations with third-party applications like Bill.com allow Quicken to operate with a much smaller accounting team than similar-size businesses, with the flexibility to accommodate complex revenue recognition processes for different product lines.

“I’ve used eight different ERP systems—from SAP to QuickBooks Online. NetSuite is perfect. It’s not too complex, not too simple. It’s flexible and powerful, but still easy to use.”

Gary Hornbeek, Corporate Controller, Quicken

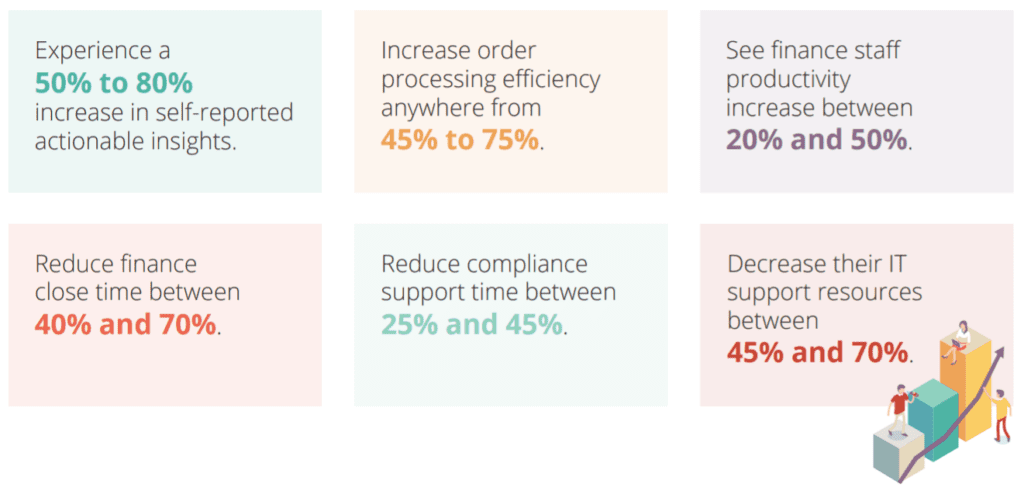

NetSuite Services Customer Results

In a recent study by SL Associates, services companies reported stunning improvements in key performance metrics after switching to NetSuite’s cloud-based solution.

Best Practices for Transitioning Away from QuickBooks

As small businesses grow, it is clear that alternatives to QuickBooks are needed, but the path forward isn’t always well defined. Here are several best practices that can smooth the path to a better solution:

- Consider a suite. Rather than perpetuating the “applications hairball” when replacing QuickBooks, many companies decide to adopt an integrated product suite. A suite platform eliminates the need to piece together different solutions. An integrated suite makes managing data much easier. Dual data entry is eliminated, since all information is stored in a single, centralized data repository. A suite solution enables companies to start with the basics and add complexity over time.

- Take time to understand the business needs and key business requirements. Before selecting a solution to replace QuickBooks, be sure the organization understands its business and key business processes. Growing companies

often believe that are saving money by not spending the time needed to understand and capture the business requirements. Unfortunately, this can lead to building the wrong solution.

- Hire a partner to help with data migration. Regardless of what platform a company adopts, it can be helpful to find a suitable partner who can help migrate data and perform checks and balances before the system goes live. This approach will ensure that the transition to a new system is consistent with business processes and objectives.

Conclusion

If your growing enterprise is experiencing any of the pains discussed where QuickBooks may be limiting your business growth, it may be time to consider the cloud-based products and services that NetSuite offers. Moving your company to NetSuite’s integrated suite of cloud-based solutions allows for more efficient and effective business operations—essential for growing an organization and enabling employees to react to client and organizational needs in real-time.