The software industry changes at a frantic pace. To adapt in this dynamic environment, organizations must be able to quickly respond to changes in market conditions, market opportunities and evolving customer expectations. Though most recognize the need to innovate, software companies have a remarkably difficult time finding business applications that can meet their needs in an effective, yet affordable manner.

Young software companies have been forced to rely upon a hairball of dangerously unreliable spreadsheets and limited point solutions like QuickBooks. The relatively low cost of maintaining those systems masks the cost of inefficiencies in route tasks like the monthly close or, more importantly, the dissemination of reliable information upon which business decisions can be confidently made in a fast-paced environment.

Software companies are especially challenged. How can spreadsheets handle complex revenue recognition and fluid pricing models? How can

“make do” accounting systems support strategic questions like:

- What was new business ARR?

- How much ARR was lost through downgrades?

- How many customers churned?

Accounting teams frequently face these demands with inadequate tools. In many cases, QuickBooks was a workable and inexpensive tool. But now they impose a number of pains.

- It’s difficult to find out what’s really happening across the business in real-time. Most systems are designed for an era when companies could wait until the end of the month to get the data they need. That’s not the case today—consolidated views and up-to-the-minute reporting can make the difference between thriving and barely surviving.

- Team members waste time playing “Hunt for the Spreadsheet.” Employees rely on spreadsheets to fill the information gap since data lives in so many disparate systems. People end up spending more time hunting for data than actually analyzing it and making decisions.

- Financial consolidation takes ages. Cross-posting transactional data between systems is time-consuming and the finance team works late every month to consolidate financial reports. Yet, as hard as they work, weekly and monthly reports are delayed.

- Sales forecasting and budgeting processes rely on guesswork, rather than facts. Since it is difficult to get historic information in the right format in a timely manner to do trend analysis, employees put figures in spreadsheets based on guesswork. Even though the actual data exists somewhere, it’s too hard to find and extract.

- More accounting is done outside of the financial system than in it. Standalone financial systems are designed to automate a limited set of core accounting functions. As a result, it limits how companies must adapt their processes to fit the application, rather than having a system that is flexible, scalable and will accommodate growth. It is easy to run out of headroom when companies have more customers, vendors or inventory items than many standalone financial systems can practically handle.

- It is too difficult to add new sales channels, product lines or revenue streams. Every time there is a change in the business, staff must work overtime to figure out workarounds to accommodate it. Standalone financial systems do not have built-in support for everyday functions like making simple changes across matrix SKUs, adding new sales tax rates, or handing bill of materials, kits and assemblies for manufacturing inventory. Processes that cry out for automation have to be done manually or from spreadsheets.

Born in the Cloud

Nobody understands the importance of true cloud better than software companies. There is a world of difference between software designed for the cloud and software designed for the legacy world. NetSuite has never been a desktop product. It has always been a multi-tenant solution. In contrast, QuickBooks Enterprise still comes in a desktop version. Even the hosted product lack the always-upgraded, strong code base of real multi-tenancy.

Quantifiable Benefits

- Delay Finance and Operations Hires – Automation frees up finance and operations’ time allowing them to focus on revenue generating strategic projects, analysis and allowing the company to scale while keeping headcount flat.

- Revenue Recognition and Subscription Models – Stop the potential for revenue leakage and identify upsell opportunities.

- Streamline Billing and Invoicing – Reduce manual entry and avoid errors with automated billing and invoicing. Collect cash faster and reinvest back into your growing business.

- Reduced Financial Close Time and Manual Data Entry – Automate and control approvals on transactions from AP Bills to Journal Entries, speed up period-end close due to system controls being in place, improve accuracy of financials, and reduce month-end processing costs and time.

- Lower Audit Costs – Ever-changing compliance standards, small accounting teams and heavy spreadsheet use are time-consuming and subject to risk. This can lead to higher audit costs, or longer and more-involved audit processes.

- Platform for Innovation – Easily launch new business models and expand internationally with a platform that evaluates all possible ways to scale and increase revenue, and supports multi-currency, multi-entity and different accounting standards.

Suite Approach

A suite approach allows the whole company to view operations as a single version of the truth. Furthermore, predefined roles and dashboards that are oriented around a user’s day-to-day tasks allow for the most efficient consumption of information throughout the entire organization.

With a well-implemented cloud-based system, financial activities appear as soon as they are triggered. That; coupled with ‘anywhere-anytime’ access, means the decision makers can quickly act upon both adverse and favorable performance indicators. In that sense, decision-making becomes an activity where those tasked with executing on the company’s goals and strategy are able to do so with information that is akin to looking through the front windshield of a car, rather than constantly worrying about what is in the rear-view mirror.

A Tool for Success

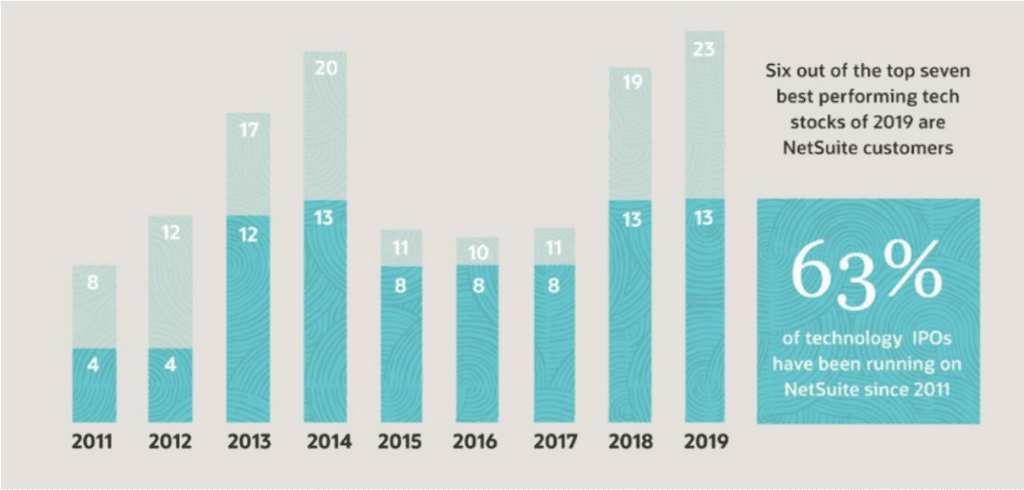

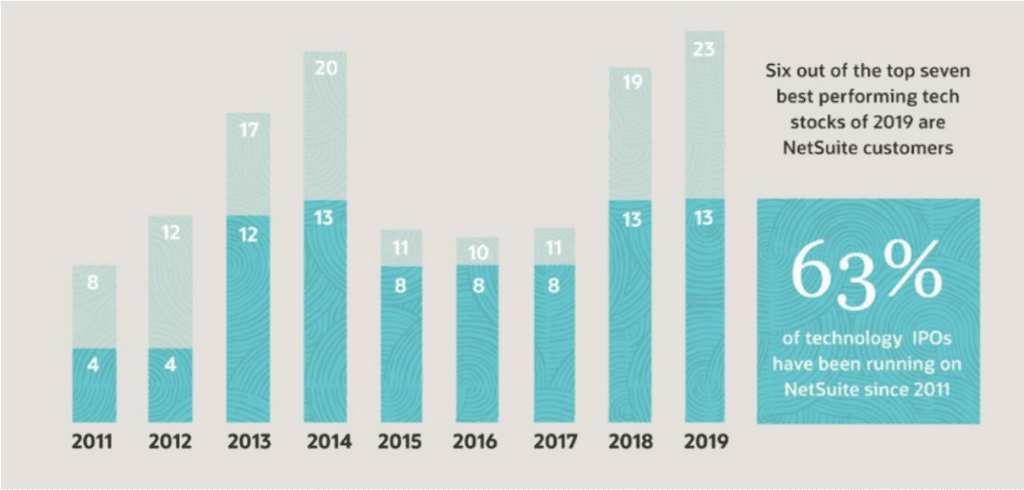

That is why the fastest growing software companies user NetSuite.

- 88% of Bessemer’s “Next Cloud Unicorns” use NetSuite

- 56 of the JMP 100 Private Software Companies

- 65% of the last 100 Tech IPOs

- 22 Wall Street Journal “Billion Dollar” Start-ups

NetSuite Helps Quicken Maintain Its Stride Through Divestiture

Fast implementation meets divestiture deadlines

Quicken chose NetSuite OneWorld for its robust functionality and integration, ease of use, and scalability, seamlessly transitioning from a temporary QuickBooks Online environment in a five-month implementation by the October 1 deadline. NetSuite empowers a lean and growing operation of 100 employees, including 30 in Bangalore.

Robust functionality, automation for efficiency

Efficiencies gained through the system and easy integrations with third-party applications like Bill.com allow Quicken to operate with a much smaller accounting team than similar-size businesses, with the flexibility to accommodate complex revenue recognition processes for different product lines.

“I’ve used eight different ERP systems—from SAP to QuickBooks Online. NetSuite is perfect. It’s not too complex, not too simple. It’s flexible and powerful, but still easy to use.”

Gary Hornbeek, Corporate Controller, Quicken

Best Practices For Transitioning Away From QuickBooks

As small businesses grow, it is clear that alternatives to QuickBooks are needed, but the path forward isn’t always well defined. Here are several best practices that can smooth the path to a better solution:

- Consider a suite. Rather than perpetuating the “applications hairball” when replacing QuickBooks, many companies decide to adopt an integrated product suite. A suite platform eliminates the need to piece together different solutions. An integrated suite makes managing data much easier. Dual data entry is eliminated, since all information is stored in a single, centralized data repository. A suite solutions enables companies to start with the basics and add complexity over time.

- Take time to understand the business needs and key business requirements. Before selecting a solution to replace QuickBooks, be sure the organization understands its business and key business processes. Growing companies often believe they are saving money by not spending the time needed to understand and capture the business requirements. Unfortunately, this can lead to building the wrong solution.

- Hire a partner to help with data migration. Regardless of what platform a company adopts, it can be helpful to find a suitable partner who can help migrate data and perform checks and balances before the system goes live. This approach will ensure that the transition to a new system is consistent with business processes and objectives.